457 withdrawal calculator

What is the impact of increasing my 457b contribution. Lets say your effective wage on date of exit was INR 15000 per year ie.

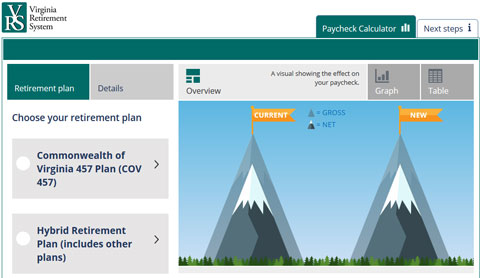

Vrs Contributions

State Income Tax Rate.

. The following COVID information was for 2020 Returns. Use this calculator to determine how long those funds will last given regular withdrawals. 457b and other defined contribution plans when you turn 72 or retire whichever is later plan permitting.

What may my 457 Plan be worth. If you turned age 70½ before January 1 2020 then your RMD age is 70½ not 72. These streams of retirement income may include funds from 401k 403b and 457 plans as well as traditional and Roth IRAs annuities and other.

Estimate your marginal state income tax rate your tax bracket based on. Youll pay a penalty tax if you withdraw funds before reaching age. The regular 10 early.

Click on a link to open calculator in a new tab. 401ks vary from company to company but many employers offer a matching contribution. 830 am - 930 pm.

Im self-employed how much can I contribute to a retirement plan. What may my 403b Plan be worth. Limits Apply to Two Plans These limits apply to any 403b and 401k accounts a taxpayer might have during the year.

Certain employers may offer both types of plans. When saving for retirement your employer may give you a hand by offering a tax-advantaged savings planYour options might include a 401k plan or a 457b plan. 401k 403b 457 Plan In the US two of the most popular ways to save for retirement include Employer Matching Programs such as the 401k and their offshoot the 403b nonprofit religious organizations school districts governmental organizations.

Impact of early withdrawal from my 401k. The 403b and 457b plans are both tax-deferred retirement savings accounts that cover nonprofit entities like governments churches and charities. One major difference is that currently 457 plans are designed for public sector employees and 401k plans are designed for private sector employees.

While there are similarities between a 457b and a 401k there are also key differences to keep in mind. Your required retirement income fixed income and overall savings with assumptions. Impact of increasing my 457 Plan contribution.

Use this calculator to estimate how much in taxes and penalties you could owe if you withdraw cash early from your 401k. Use our loan payment calculator to determine the payment and see the impact of these variables on a specified loan amount complete. Our Retirement Withdrawal Calculator collects your personal financial information for three different areas.

A 457b is similar to a 401k in how it allows workers to put away money into a special retirement account that provides tax advantages letting you grow your savings tax-deferred over time. What is the impact of early withdrawal from my 401k. Your tax bracket based on your current earnings including the amount of the cash withdrawal from your retirement plan.

What is the impact of increasing my 457b contribution. What may my 457b be worth. What may my 457b be worth.

These withdrawal benefits are only applicable if. Comparing mortgage terms ie. Early Withdrawal Calculator.

15 20 30 year. As a result of the June 2020 CARES Act retirement account holders affected by the Coronavirus could access up to 100000 of their retirement savings as early withdrawals penalty free with an expanded window for paying the income tax they owed on the amounts they withdrew. The financial calculator results shown represent analysis and estimates based on the assumptions you have provided but they do not reflect all relevant elements of your personal situation.

What may my 403b Plan be worth. How a 457b plan differs from a 401k plan. Open an IRA or roll over a 401k 403b or governmental 457b plan to an IRA.

You may have to devote some time to tracking your contributions to your 401k and 403b plans to make sure that you dont contribute more than the amount allowed if you have two or more jobs or if you switch jobs in the middle of the year. Another significant difference between these plan types concerns the application of the additional 10 early withdrawal tax. What is the impact of early withdrawal from my 401k.

What is the impact of early withdrawal from my. Both plans allow you to contribute money towards retirement on a tax-deferred basis. What is the impact of increasing my 457b contribution.

Im self-employed how much can I contribute to a retirement plan. The maximum contribution of INR 1250 per month and hence your withdrawal benefit will be INR 15000 754 ie. They differ in that 403b withdrawal rules are more like 401k withdrawals.

Im self-employed how much can I contribute to a retirement plan.

457b Plans Non Qualified Deferred Compensation Plans Apa

401 K Vs 403 B Vs 457 Plans Compare Employer Sponsored Retirement Plans Mybanktracker

How To Utilize Your Non Governmental 457 B Plan White Coat Investor

457 Plan Types Of 457 Plan Advantages And Disadvantages

Can I Max Out My 401k And 457 Here S How It Works

2

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Early Retirement

457 Retirement Plans Their One Big Advantage Over Iras Money

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

457 B Vs Roth Ira Why You Might Opt For A 457 B Seeking Alpha

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

403 B Vs 457 B What S The Difference Smartasset

457 Vs Roth Ira What You Should Know 2022

A Guide To 457 B Retirement Plans Smartasset

457 Contribution Limits For 2022 Kiplinger

457 Deferred Compensation Plan

457 Retirement Plan Explained Youtube